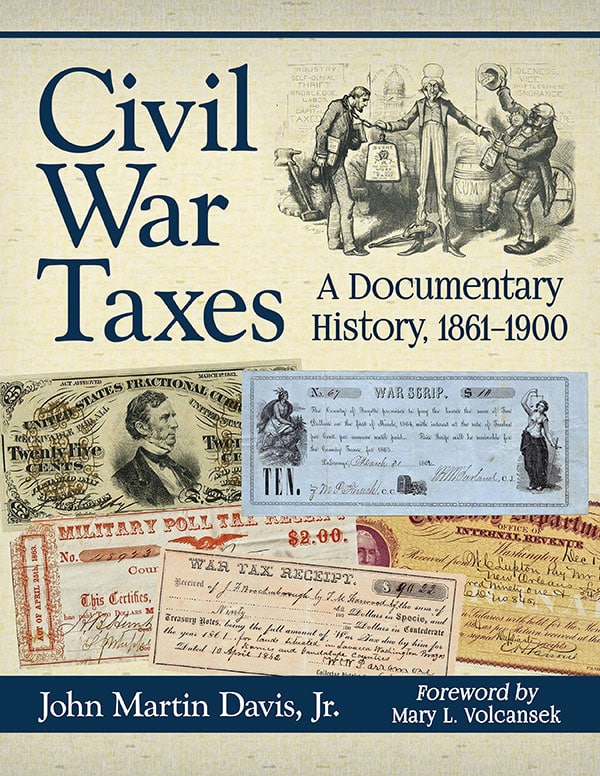

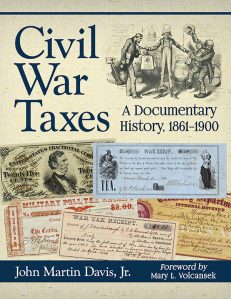

Civil War Taxes

A Documentary History, 1861–1900

$49.95

In stock

About the Book

During the Civil War, both the North and South were challenged by fiscal and monetary needs, but physical differences such as gold reserves, industrialization and the blockade largely predicted the war’s outcome from the onset.

To raise revenue for the war effort, every possible person, business, activity and property was assessed, but projections and collections were seldom up to expectations, and waste, fraud and ineffectiveness in the administration of the tax systems plagued both sides.

This economic history uses forensic examination of actual documents to discover the various taxes that developed from the Civil War, including the direct and poll taxes, which were dropped; the income tax, which stands today; and the war tax, which was effective for only a short time.

About the Author(s)

Bibliographic Details

John Martin Davis, Jr.

Format: softcover (8.5 x 11)

Pages: 173

Bibliographic Info: 124 photos, notes, bibliography, index

Copyright Date: 2019

pISBN: 978-1-4766-7794-1

eISBN: 978-1-4766-3671-9

Imprint: McFarland

Table of Contents

Foreword by Mary Volcansek 1

Preface 3

I—Antebellum United States Taxes, 1789–1860 7

II—United States Taxes, 1861 12

III—Confederate States Taxes, 1861 16

IV—United States Taxes, 1862 20

V—Confederate States Taxes, 1862 24

VI—United States Taxes, 1863 27

VII—Confederate States Taxes, 1863 33

VIII—United States Taxes, 1864 38

IX—Confederate States Taxes, 1864–1865 43

X—United States Taxes, 1865 50

XI—Post-War United States Taxes, 1866–1900 59

Conclusion 67

Illustrations 69

Chapter Notes 155

Bibliography 159

Index 163

Book Reviews & Awards

“Davis sheds light on one of the murkier corners of the Civil War, how it was financed, with a particular concentration on taxation…invaluable insights”—The NYMAS Review